On 1 December 2021, the EU published the recently approved Directive on public country-by-country reporting, Directive (EU) 2021/2101 (the “CBCR Directive”). The CBCR Directive requires multinational entities and standalone entities with a consolidated revenue over EUR 750 million for each of the last two consecutive financial years to publicly disclose certain information (including details as to revenues, number of employees and amount of tax paid) in respect of their activities in each EU Member State, as well as in certain third countries. This information will need to be published on the group’s website by December 2026 for in-scope entities with a 31 December year-end.

Scope of the CBCR Directive

The CBCR Directive requires multinational enterprises (whether headquartered in the EU or outside) and standalone undertakings with activities in the EU and a total consolidated revenue of more than EUR 750 million (USD 915 million) in each of the last two consecutive financial years to publicly disclose specified information (detailed below) in respect of their activities in each EU Member State, as well as in certain third countries. EU branches of undertakings located outside the EU can also trigger a reporting requirement where the parent undertaking satisfies the EUR 750 million revenue threshold.

An exemption applies where the relevant entity only has a presence in one single EU Member State or if the undertaking is already subject to similar reporting obligations.

Where the parent of a multinational group is established outside the EU, a reporting obligation will arise where an EU subsidiary constitutes a “medium” or “large” undertaking under the terms of the EU Accounting Directive 2013/34/EU. Broadly, this means that a multinational group will be required to file a public CBCR report where it has an EU subsidiary that exceeds at least two of the following three criteria:

(i) balance sheet total: €4,000,000;

(ii) net turnover: €8,000,000; or

(iii) average number of employees during the financial year: 50.

If an EU subsidiary does not have all necessary information required to be published under the CBCR Directive, it must request this information from its parent entity or publish a statement that the parent has not made the necessary information available.

Information to be disclosed publicly

Where a reporting obligation arises, the entity must disclose the following information in the form of an income tax report (the “Report”):

- name of the relevant undertaking, the financial year concerned, the currency used and, where applicable, a list of all subsidiary undertakings in the EU and subsidiaries listed on the EU blacklist or greylist;

- a brief description of business activities;

- number of full-time employees;

- details of revenues, profits or loss before income tax and accumulated earnings;

- amount of income tax accrued during relevant financial year; and

- amount of income tax paid on a cash basis.

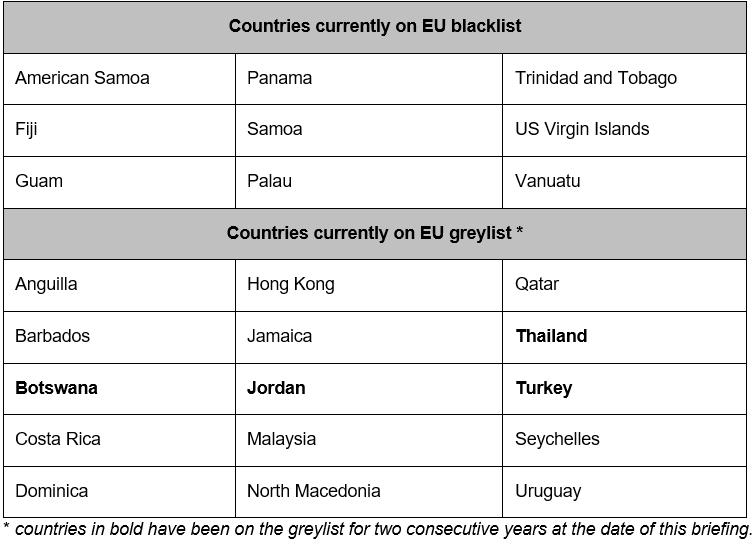

The Report must be made on a country-by-country basis for all EU Member States as well as for each jurisdiction included in the EU blacklist or included on the EU greylist for two consecutive years. For all other third country tax jurisdictions, the Report can be made on an aggregated basis.

The countries currently on the EU blacklist and greylist are as follows:

The CBCR Directive provides for a safeguard clause whereby certain information can be temporarily withheld from the Report where its disclosure would be seriously prejudicial to the commercial position of the undertaking. However, such information must be disclosed within the next five years, and reasons for the non-disclosure must be provided.

Publication and accessibility of the Report

The Report must be made accessible to the public and free of charge on the website of the relevant undertaking for a minimum of five consecutive years. The Commission intends to lay down a common template which must be followed when making the Report.

EU Member States also have the option of allowing undertakings to publish the Report on a public central, commercial or companies register which must be referenced on the website of the relevant undertaking. Access to any such public register must be available free of charge. It remains to be seen whether this option will be adopted by individual EU Member States.

Implementation timeline

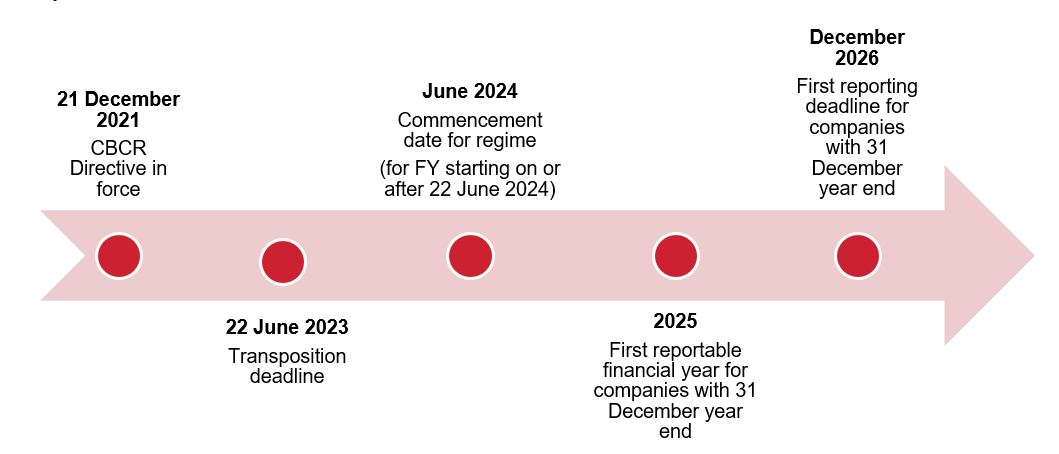

The CBCR Directive will enter into force on 21 December 2021 and EU Member states will be required to transpose the CBCR Directive into national law by 22 June 2023. The reporting requirements will apply at the latest for all financial years starting on or after 22 June 2024 but could potentially apply from an earlier date depending on domestic implementation.

The Report must be published within 12 months of the balance sheet date of the relevant financial year. This means that in-scope entities with a 31 December year end will need to publish relevant information by December 2026.

Responsibility for the Report

The members of the administrative, management and supervisory teams of the relevant undertaking have collective responsibility for ensuring that the Report is drawn up, published and made accessible within the required timeframe.

In addition, statutory auditors will be required to confirm and state whether a company falls within the scope of the rules and whether the Report was published in accordance with the provisions of the CBCR Directive.

There are no specific penalties included in the CBCR Directive and it is up to EU Member States to provide for penalties and ensure those penalties are enforced upon implementation into domestic law.

Review of the CBCR Directive

The impact and effectiveness of the CBCR Directive will be reviewed by 22 June 2027. This review will examine, in particular:

- whether it would be appropriate to extend the reporting obligation to smaller undertakings;

- the impact of allowing data for third-country jurisdictions to be provided on an aggregated basis; and

- the operation of the safeguard clause.

The Matheson tax team will continue to keep you updated on the implementation of the CBCR Directive in Ireland. Should you have any questions on the above or if it would be helpful to discuss further with a member of our tax team, please do not hesitate to contact us.